Texas Connect Overview

AS OF November 30, 2025

There are currently no changes to the offering circular.

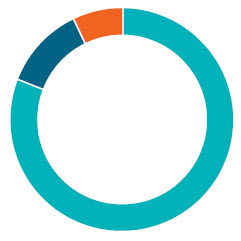

Asset Allocation

| • |

Commercial Paper |

81% |

| • | Bank Obligations |

12% |

|

•

|

Mutual Funds |

7% |

Pool Characteristics

| 1-Day Yield | 4.12% |

| Expense Ratio | 0.040% |

| WAM (Final) | 81.44 days |

| Percentage of Pool’s Portfolio with > 1-Year Maturity | 0.00% |

| Amortized Cost | $1,220,841,224.00 |

| Market Value | $1,220,721,998.00 |

| Net Assets |

$1,219,055,697.00 |

| Number of Participants |

22 |

| Custodian | US Bank |

The performance data shown represents past performance, which does not guarantee future results. Yields will fluctuate as market conditions change. Yields shown may reflect fee waivers by service providers that subsidize the operating expenses of the pool. Yields would be lower than if expenses were not waived. Current performance may be lower or higher than the performance data quoted. An investment in Texas Connect is not insured or guaranteed by any government or government agency. Although the program seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

Texas Connect is offered only to local governmental entities in the State of Texas who qualify as Participants under the Connect Investment Trust. The program is not available to other institutional or retail investors and no offer to sell, solicitation, or recommendation of any security or investment product is intended. Eligible Participants should consider the program’s investment objectives, risks, charges and expenses before investing. This and other information about the program are available in the program’s Information Statement. A copy of the Information Statement may be reviewed on this website. Please read the Information Statement carefully before investing.

1-Day Yield represents the annualized net yield for the report date. Weighted Average Maturity represents the average of the final maturities of all securities held in the portfolio as of the report date.